Damage management in the vehicle fleet - This is what you should pay attention to!

17. Apr 2023 | By Malena Gärtner

Successful and cost-conscious fleet damage management places high demands on every fleet manager, so it is important to know exactly what needs to be done in the event of a damage.

What is fleet damage management?

Effective fleet damage management can help reduce operating costs, increase productivity and improve the safety of drivers and other road users.

Fleet damage management usually begins with accident and damage prevention, including measures such as monitoring driving behavior, training drivers in safe driving, and performing regular maintenance on vehicles to ensure they are in good condition.

If an accident or damage does occur, it is important to act quickly to minimize costs and reduce downtime. Fleet damage management therefore involves responding quickly to damage, assessing the damage, communicating with the parties involved and organizing the repair or replacement of the damaged vehicles.

What challenges does damage management pose for fleet managers?

Fleet damage management presents several challenges to the fleet manager, including:

- Cost management: damage to vehicles can be very expensive, especially if it results in vehicle breakdown, so the fleet manager must be able to control and minimize damage costs to maintain fleet profitability.

- Time Management: Damage to vehicles can result in downtime that can affect fleet productivity and efficiency, so the fleet manager must be able to respond quickly and arrange for the repair or replacement of damaged vehicles to minimize downtime.

- Risk management: damage to vehicles can also increase the risk of injury or accidents, so the fleet manager must be able to identify and minimize risks to ensure the safety of drivers and other road users.

- Data Management: fleet damage management requires the collection and management of accident and damage data, so the fleet manager must be able to analyze this data to identify trends and patterns that can help prevent future damages.

- Communication: fleet damage management requires clear and effective communication with the parties involved, including drivers, insurance companies and repair shops, so the fleet manager must be able to communicate effectively to ensure claims are handled quickly and efficiently.

Settlement damage management explained step by step:

Handling a fleet damage can vary depending on the type and severity of the damage, but in general there are some steps that are usually followed:

- Accident or damage report: if an accident or damage occurs, the driver should immediately notify the fleet manager or a designated person. A damage report should be completed and forwarded to the insurance company.

- Damage assessment: The damage is assessed by an expert or an insurance agent to determine the extent of the damage.

- Claims settlement: the fleet's insurer and, if applicable, the insurers of other parties involved settle the claim, determining the cost of repair, replacement or indemnification for the damage.

- Repair & Follow-up: If the damaged vehicle can be repaired, it is repaired in the workshop. If the vehicle cannot be repaired or the damage is too extensive, the vehicle is replaced. After the repair, an inspection is carried out to ensure that the vehicle has been fully repaired and is once again fully operational.

- Documentation: All steps of the claims process should be documented, including notification of the claim, recording of the claim, settlement of the claim, repair or replacement of the vehicle, and follow-up inspection.

- Analysis and prevention: The fleet manager should analyze claims processing to identify trends and patterns and, if necessary, take action to prevent future claims.

It is important that claims are handled quickly and effectively to minimize downtime and costs, and clear communication with all parties involved is essential.

Digital damage management

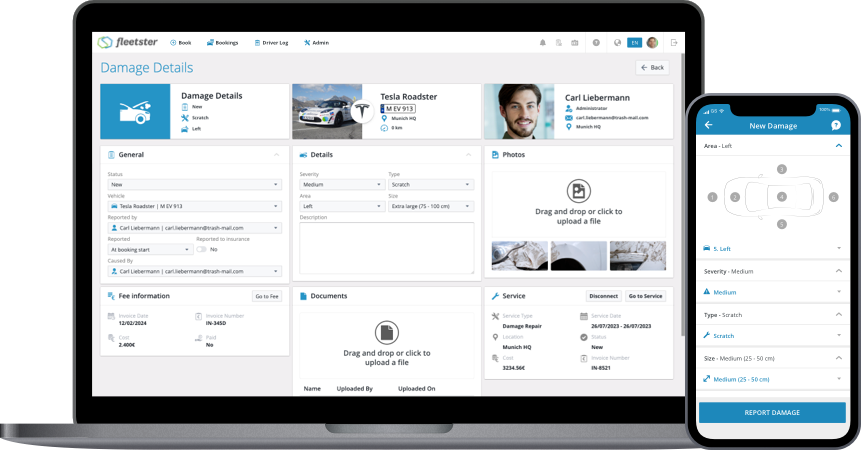

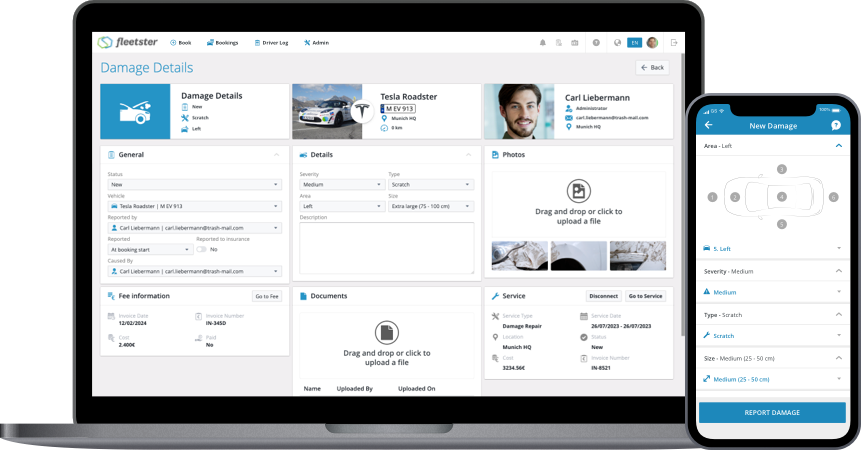

Using a digital damage management software for fleets can make damage processing much easier and better. Here are some of the benefits that digital damage management software can provide:

- Quick claim notification: digital claims management software allows drivers to report accidents or damage quickly and easily. The software can automatically collect all the necessary information and forward it to the fleet manager or person in charge.

- Automatic damage recording: digital damage management software can capture images of damage, which can help quickly determine the extent of the damage.

- Efficient damage settlement: Digital claims management software can automate and speed up the claims process by sending claims notifications to insurers and monitoring the progress of claims settlement.

- Repair management: digital claims management software can automatically schedule and coordinate the repair of damaged vehicles.

- Documentation: digital claims management software can automatically document and archive all steps of the claims process, including claims reporting, claims intake, claims settlement, repair and follow-up.

By using digital claims management software, fleet managers can save time and resources, speed up claims processing and improve fleet profitability.

The Damage Management App

A damage management app allows drivers to report damages quickly and easily.

For successful fleet damage management, you need to be informed immediately as soon as damage is detected on one of the vehicles. You need to be in the know, whether it's dirty seat covers or a missing light. Only then is good claims management KFZ possible. However, not all drivers report promptly and reliably.

To improve fleet damage management, we have developed a damage management app that makes it easier for drivers to record damage and significantly improves reporting reliability. The damage management app is straightforward. Similar to the program, drivers can report the damage, describe it, or upload photos. Documenting the defects on the vehicle takes just a few clicks. If the damage has already been reported, it is visible at a glance.

The information is immediately forwarded to you, the fleet manager, allowing you to prioritize defects during claims processing, quickly order replacement parts from the repair shop, and reduce downtime. Once the claim is processed, the damage disappears from the app.